Orbs is excited to announce a new product launch: Perpetual Hub, a full suite of tools for on-chain perpetual futures trading!

In collaboration with SYMMIO and IntentX, Orbs is poised to revolutionize the on-chain derivatives market by providing the best execution and deepest liquidity compared to existing alternatives.

With Perpetual Hub, the latest product in development to be powered by Orbs’ novel layer 3 technology, the full potential of on-chain perpetual futures can be realized like never before.

Looking at the top spot and derivatives centralized exchanges like Binance, OKX, Bitfinex, etc., we can see that perpetual futures trading volumes can be an order of magnitude greater than spot trading volumes.

The main reason for these high volumes is that derivatives trading can be accomplished using leverage, often as much as x100, which enables users to increase their trading position beyond what would be available from their cash balance alone amplified by deeper liquidity that perpetual markets offer.

As highlighted by Orbs' Head of BizDev, Ran Hammer, during his keynote address at the recent ETHDenver conference, the total value locked (TVL) in on-chain derivatives stands at $3.4 billion, a fraction of the DeFi market's overall TVL of approximately $100 billion. Additionally, decentralized exchanges (DEXs) contribute a mere 2% to the total crypto derivatives trading volume.

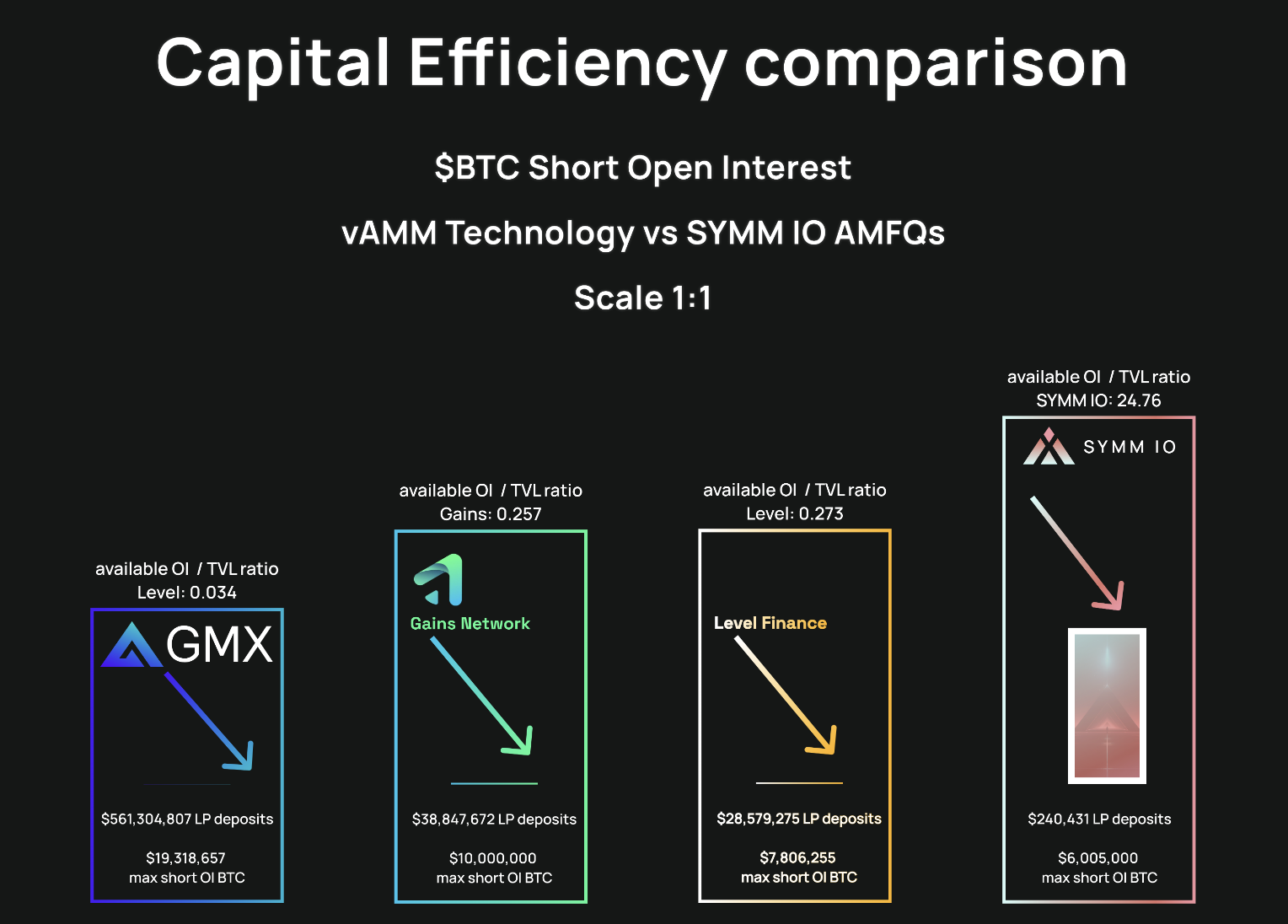

The SYMMIO protocol is a new way of trading derivatives that focuses on isolating risk between 2 parties, instead of co-mingling risk between all parties. This especially reduces the long-tail risk, making on-chain trading more efficient and faster. Unlike other platforms that rely on having lots of money locked up (over-collateralization) to cover potential losses, SYMMIO matches individual buyers and sellers directly using intent-based execution. This means you can trade with more leverage without needing as much money upfront. Compared to other platforms, SYMMIO stands out for its ability to offer better deals and more options for trading different assets.

These findings underscore SYMMIO's potential to revolutionize decentralized trading platforms, offering unparalleled capital efficiency and diverse trading possibilities.

But how does Orbs fit into all this?

The Orbs project has recently joined forces with SYMMIO and IntentX to address the challenge of capital efficiency in on-chain derivatives trading and propel it to new heights.

Similar to other intent-based platforms such as UniswapX or CoWSwap, a crucial element is that of Solvers, known as Hedgers in the SYMMIO protocol. Solvers are third-party entities that compete to fulfill orders submitted by users, forming the backbone of any intent-based model.

Orbs has recently launched Liquidity Hub, a decentralized intent-based optimization layer that operates above Automated Market Makers (AMMs), powered by Orbs’ novel layer 3 technology. Perpetual Hub provides a related solution for decentralized perpetual platforms.

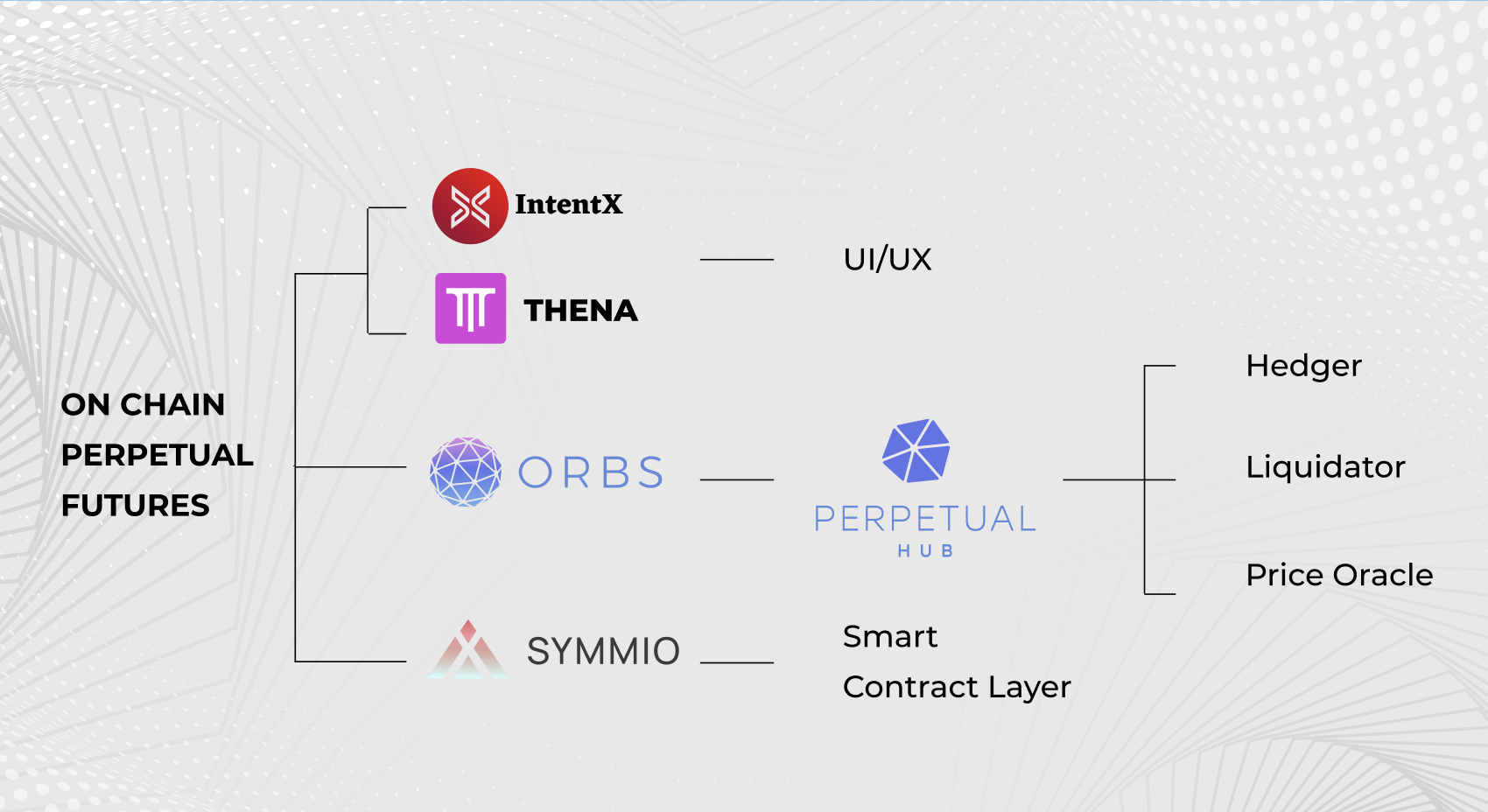

While SYMMIO is the smart contract layer of intent-based perpetual futures trading and IntentX runs the frontend UI, Orbs completes this powerful trio with Perpetual Hub - a decentralized protocol for the necessary functions required for the intent-based engine to operate.

Together, these three projects are pioneering a revolutionary architecture for an intent-based perpetual futures trading platform. This innovative technology promises significantly enhanced liquidity compared to other derivatives platforms, resulting in a substantial increase in capital efficiency and offering the deepest liquidity available on-chain.

Perpetual Hub, under development by Orbs, is a full suite of services that enable on-chain perpetual futures trading, powered by Orbs decentralized layer 3 execution services.

These services include:

Hedger

A Market Maker operating on a SYMM-powered frontend like IntentX, the Hedger provides liquidity by filling user orders. Acting as the counter-party to trades, Hedgers can leverage external liquidity sources, including centralized exchanges like Binance, for unparalleled liquidity.

Liquidator

In line with standard practices in perpetual futures trading platforms, SYMMIO supports leverage trading. Users are required to lock collateral on-chain when initiating leveraged positions. Should the collateral value dip below the maintenance margin threshold, third-party Liquidators will liquidate the user's position, earning a liquidation fee as compensation.

Price Oracle

In the blockchain realm, oracles bridge off-chain and on-chain data. Price oracles are an important component of the system which are needed to provide uPnL (unrealized profit and loss) of accounts, flagging liquidations, and more.Therefore, having a reliable and robust price oracle, while maintaining proper decentralization, is essential for the platform to run smoothly.

All three software solutions leverage the power of the decentralized Orbs Network, with its Guardians and proof-of-stake ecosystem, to allow platforms, market participants, and other third parties to provide and operate this suite of decentralized services. Orbs will not be engaging in trading, hedging or serving as a liquidator.

Through its novel Layer 3 technology, Orbs enhances the capabilities of smart contract platforms, providing essential services to DEXs across DeFi.

In addition to Perpetual Hub, Orbs toolbox for DEXs include:

With this latest product release of Perpetual Hub, Orbs is positioning itself as a major DeFi building block for DEXs in both spot and futures markets. Orbs services are already integrated into dozens of DEXs across multiple chains, with many more in the pipeline.

For more updates, be sure to join the Orbs official Telegram group and follow Orbs on Twitter!

The Perpetual Hub is a beta version that is still under active development and all underlying digital assets, blockchain networks, and DEX platforms are also subject to ongoing development and various risks, as such, Perpetual Hub or the underlying platforms

(a) may contain bugs, errors, and defects,

(b) may function improperly or be subject to periods of downtime and unavailability,

(c) may result in total or partial loss of funds.

Any use of any platform, application and/or services described here is at your own risk and you are solely responsible for all transaction decisions.

We use cookies to ensure that we give you the best experience on our website. By continuing to use our site, you accept our cookie policy.