Sushi, the leading multi-chain DEX, has integrated the dLIMIT and dTWAP protocols powered by Orbs across its multichain ecosystem!

As a result, Sushi traders will now have access to both advanced order types, enabling traders to guarantee the price of their orders or break up large orders into smaller trades. This development follows successful integrations with other prominent DEXs. With each integration, Orbs' position as the go to solution for DeFi advanced orders is solidified, showcasing Orbs' novel layer 3 technology bringing CeFi-level execution to DeFi.

dLIMIT is a fully decentralized, permissionless, and composable DeFi protocol developed by the Orbs team and powered by the Orbs Network. Furthermore, in addition to Limit orders, SushiSwap will also integrate decentralized time-weighted average price orders (TWAP, or DCA in the case of Sushi) by Orbs, enabling the execution of this commonly used algorithmic trading strategy.

Orbs is a decentralized protocol operated by a public network of permissionless validators using PoS. Tens of millions of dollars are staked in TVL. The protocol optimizes on-chain trading with L3 use cases that include aggregated liquidity, advanced trading orders, and decentralized derivatives, enabling a DeFi trading experience as efficient as CeFi.

Trade with CeFi-level execution on a DEX

In the past month, Sushi supported a transaction volume of over 200 million dollars at the time of writing. dLIMIT & DCA will expand Sushi's current offerings, potentially opening up another avenue for the project to increase trading volumes.

For those who are unfamiliar, a Limit order allows users to buy or sell tokens at a specific price. While the specified price is guaranteed, the execution of the order is not and depends on price movement. Limit orders will only be executed if the market price meets the order specifications.

A DCA order is a trading strategy that aims to reduce the impact of buying an asset all at once by breaking the order down into smaller portions that are then executed over time. By executing smaller orders, this approach minimizes the price volatility and gradually enables traders to acquire various assets over a specific period. In crypto, this is particularly useful as prices are constantly changing.

Sushi's traders can now utilize these key traditional finance orders without sacrificing decentralization.

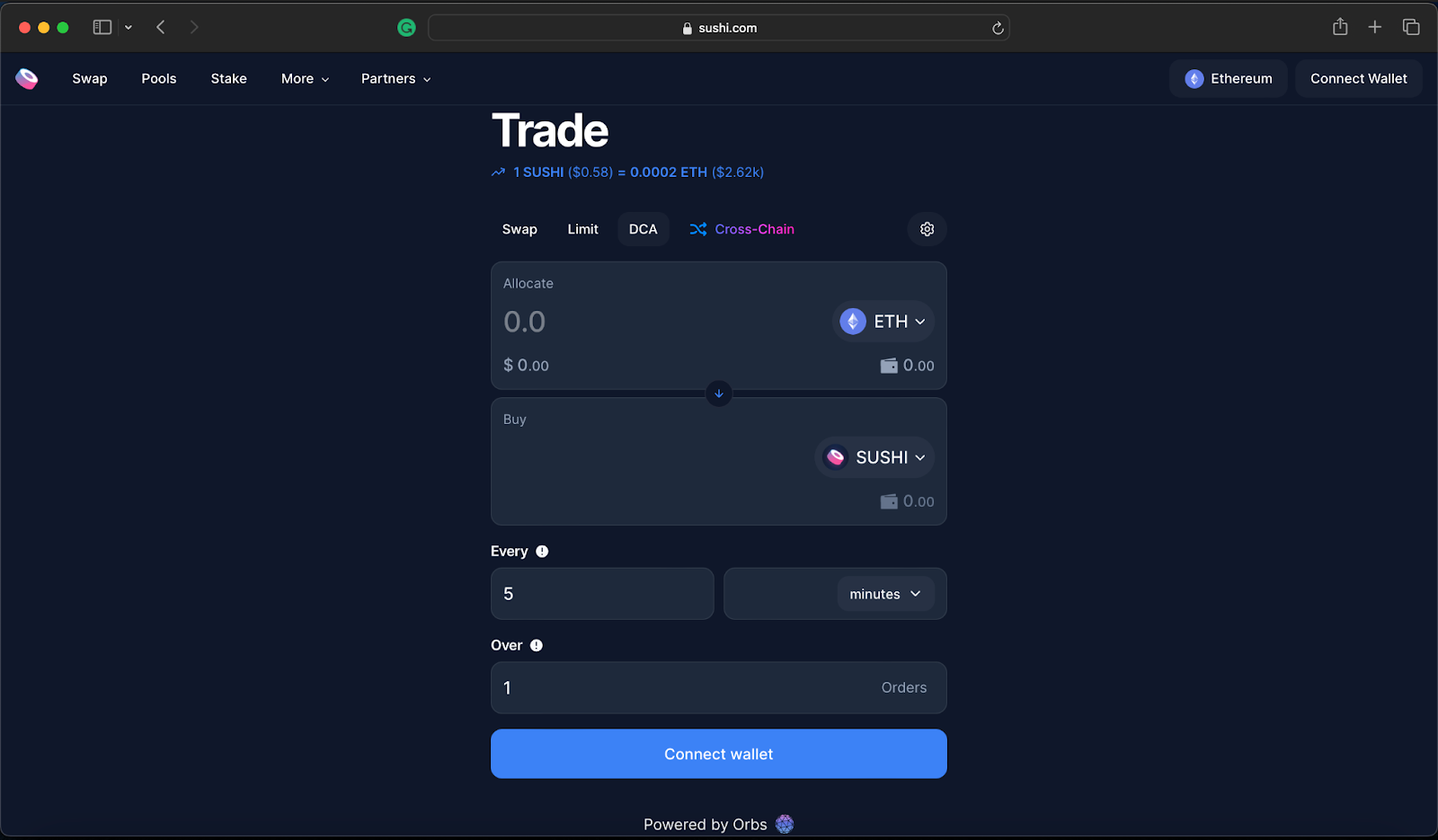

Setting up a dLIMIT and DCA orders

When switching to a dLIMIT 'swap' on SushiSwap, users are presented with an easy-to-follow user interface alongside an order history tab to keep track of previous transactions.

Before executing a dLIMIT order, traders must specify the following:

Allocate: The token that they currently have

Buy: The token that they wish to swap for

Limit price: Trades will ONLY be executed when the available market price is equal to or better than the Limit price.

dLIMIT takes into account current market conditions, prices, and gas fees. Once the parameters are set, the user can approve the specific source token, place the order, and review their order's status in the 'order history' tab.

For a DCA orders, two additional parameters need to be specified:

Every: The estimated time that will elapse between each trade in your order.

Over: The total number of individual trades that will be scheduled as part of the DCA order.

These parameters provide incredible flexibility in customizing each order, considering factors like market conditions and current gas fees. With these parameters, users can set up a DCA order for executing strategies such as dollar cost averaging, for example. Additionally, the UI facilitates DCA-market orders, which execute all trades at the available market price, and DCA-Limit orders, which only execute individual trades if they are within the price Limit set by the user. Once these parameters are set, the user can approve the specific source token, place the order, and confirm their specified configuration.

Redefining Trading Standards on Decentralized Exchanges

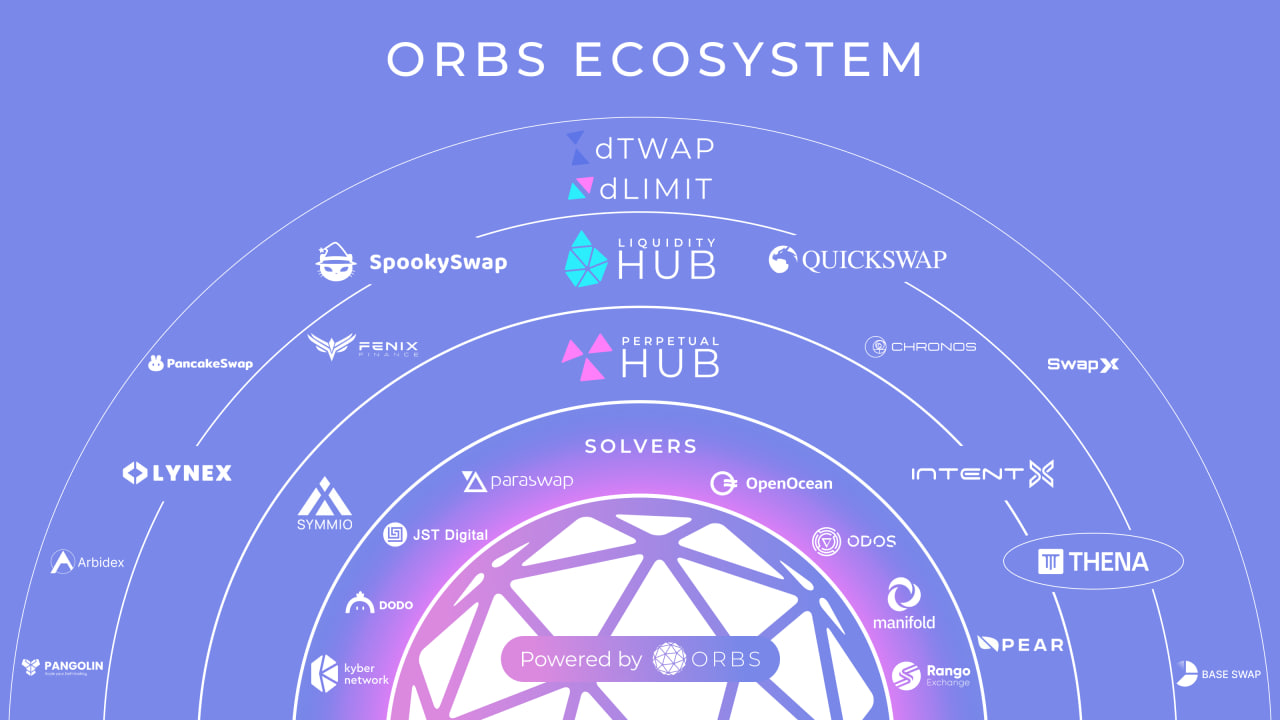

The dLIMIT & dTWAP protocols, powered by Orbs L3 technology, have become the industry standard for decentralized algorithmic orders in DeFi. The 'powered by Orbs branding' has become a staple of confidence when executing advance orders on decentralized venues.

Together with its other products: LIquidity Hub for aggregated liquidity and Perpetual Hub for decentralized on-chain perpetual futures, Orbs protocols have been implemented by 12 prominent DEXs spanning 7 chains.

Join the support telegram channel for more information regarding both advanced order types.

Find out more info:

Sushi is a leading multi-chain decentralized exchange (DEX), deployed across more than 35 blockchains. It offers a unique cross-chain swap feature, SushiXSwap, enabling seamless swaps across 15 chains. With Sushi, you can swap, provide liquidity, and access advanced trading and DeFi solutions for the ultimate DEXperience.

Orbs is a decentralized Layer-3 (L3) blockchain designed specifically for advanced on-chain trading.

Utilizing a Proof-of-Stake consensus, Orbs acts as a supplementary execution layer, facilitating complex logic and scripts beyond the native functionalities of smart contracts. Innovative protocols like dLIMIT, dTWAP, Liquidity Hub, and Perpetual Hub push the boundaries of DeFi and smart contract technology introducing CeFi-level execution to on-chain trading.

The project's core team comprises over thirty dedicated contributors globally from Tel Aviv, London, New York, Tokyo, and Seoul.

For more information, please visit www.orbs.com, or join our community at:

Telegram: https://t.me/OrbsNetwork

Twitter: https://twitter.com/orbs_network

We use cookies to ensure that we give you the best experience on our website. By continuing to use our site, you accept our cookie policy.