We are excited to announce that Orbs has been added to the Alpaca Finance vaults!

Alpaca Finance is one of the most innovative DeFi projects on Binance Smart Chain. As of today, it is the largest lending protocol allowing leveraged yield farming on BSC.

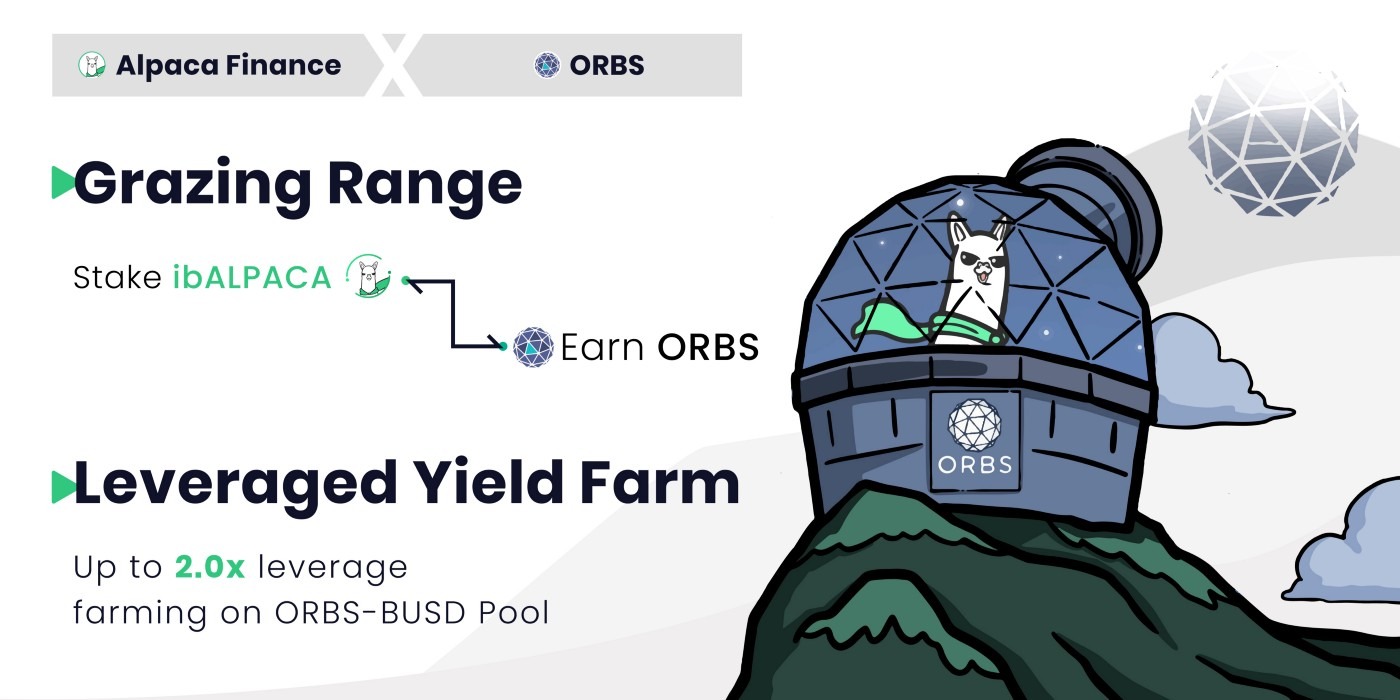

In a new initiative, Orbs holders will be able to increase their yields by using the Grazing Range and Leveraged Farming features offered by Alpaca.

The Alpaca pool will go live on July 13th, 2021 at 10 AM GMT.

Read all about it in the following link:

https://medium.com/alpaca-finance/grazing-range-pool-10-welcoming-orbs-to-the-herd-257e6fb2a935

Alpaca Finance is an advanced DeFi protocol. We encourage everyone to read thoroughly the documentation offered by the project to make sure they understand the actions they are taking.

As always, exercise caution when working with 3rd party technologies and educate yourself regarding the risks involved.

Alpaca users will be able to deposit their own ORBS tokens (on BSC) and BUSD and, through Alpaca’s protocol, open leveraged yield farming positions up to 2.0x on PancakeSwap’s ORBS-BUSD pair, which currently yields ~120% APR in CAKE Rewards. Leveraged yield farmers in the ORBS-BUSD pool will, on top of the leveraged yield farming rewards and trading fees from Pancake in the form of additional ORBS and BUSD, also receive bonus rewards in ALPACA tokens.

Note: leveraged farming entails certain risks as discussed below.

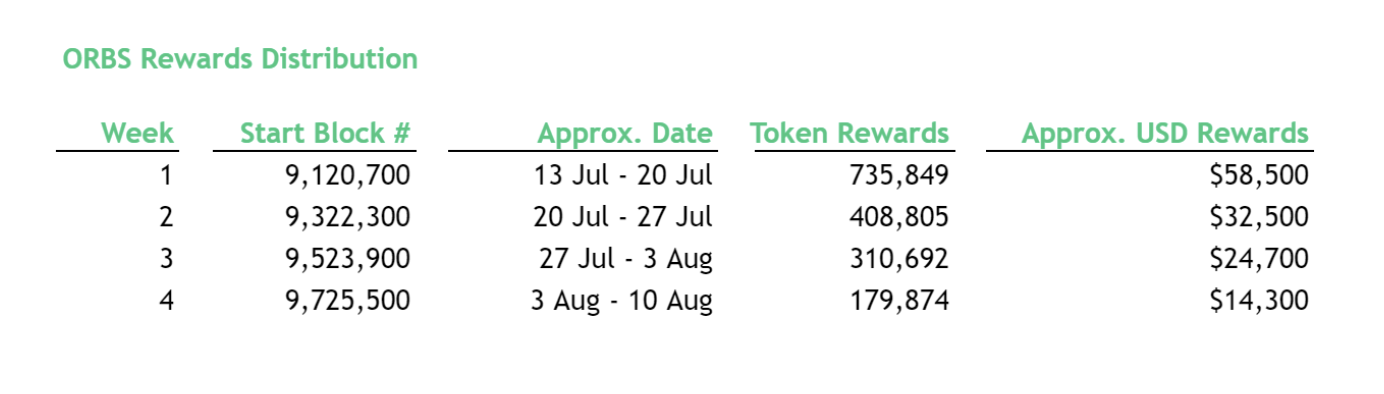

The Alpaca Tokens received when opening a leveraged farm can further be used in the Alpaca Grazing Grounds to earn ORBS tokens which will be distributed over 4 weeks as shown below:

As mentioned above, Alpaca users will be able to open leveraged yield farming positions up to 2.0x on PancakeSwap’s ORBS-BUSD pair.

Leveraged yield farming means that the user borrows assets in order to open a larger position than he actually holds. These borrowed assets carry borrowing interest.

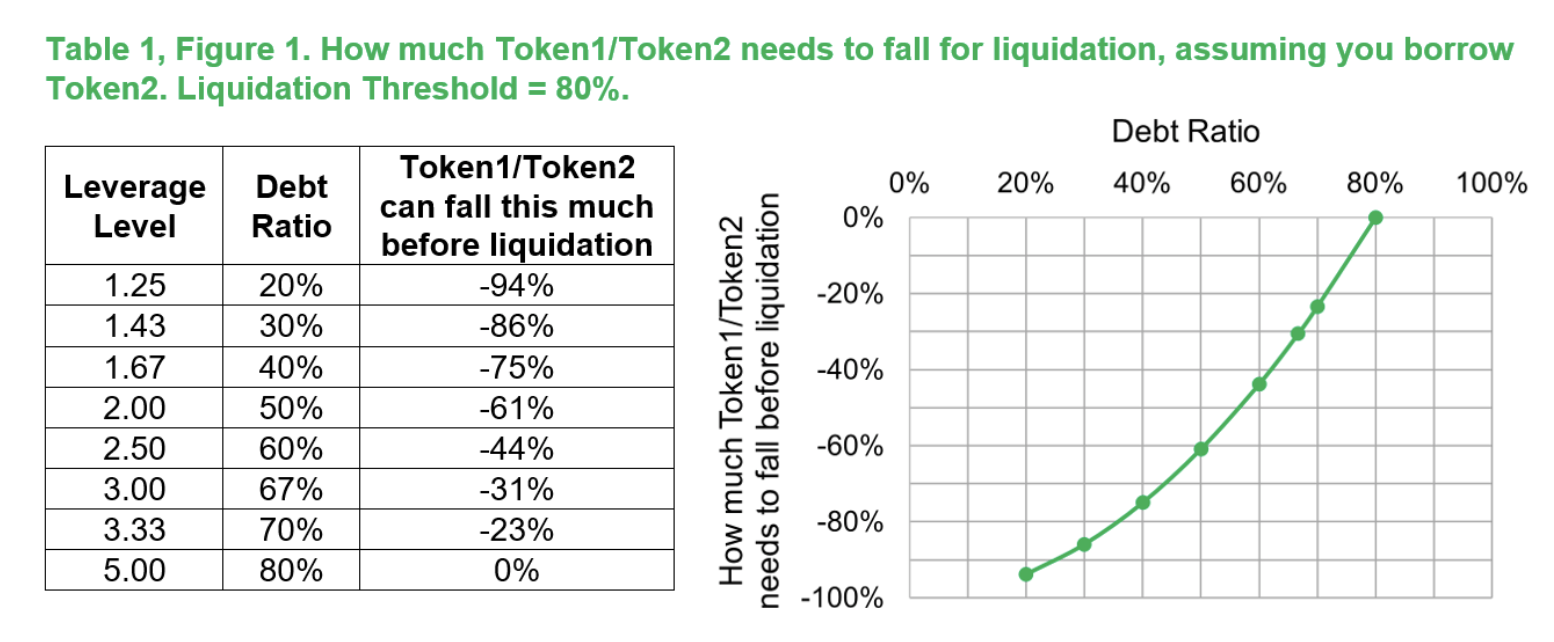

When engaging in leveraged farming, the protocol needs to make sure you’ll be able to pay back that loan. So the amount you add from your funds acts as collateral, which grows as you accumulate yields (minus borrowing interest). That collateral has to remain above the amount you owe (plus a safety margin) or the protocol may close your position to pay back lenders, which is called liquidation.

Liquidation can take place in case of high market volatility and extreme price movements, as shown in the table below:

Opening leveraged positions can be very risky and users should be aware of the consequences.

The Orbs project’s integration into BSC has been booming in recent weeks!

After adding the ORBS token to PancakeSwap at the end of April 2021, we have seen great followup initiatives taking place on BSC:

All of the above led to a significant increase in the Orbs community’s on-chain activity on BSC. Furthermore, such integration by leading protocols exhibits confidence in the Orbs project and further solidifies Orbs’ presence in the DeFi space.

We use cookies to ensure that we give you the best experience on our website. By continuing to use our site, you accept our cookie policy.